UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant |  | Filed by a party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material Pursuant to §240.14a-12 |

CARDINAL HEALTH, INC.

(Name of Registrant as Specified in its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | ||

| No fee required. | |

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| Fee paid previously with preliminary materials. | |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount previously paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

Letter to Cardinal Health Shareholders

Gregory B. Kenny

Chairman of the Board

September 20, 2019[ ], 2020

TheBoardofDirectorstakesseriouslyitsoversightroleandresponsibilityforgoodcorporategovernanceaswestrivetocreatevalueforourshareholders.Over the past year, weitismoreapparentthaneverthatCardinalHealthplaysacriticalroleinthehealthcaresupplychain.I,alongwiththerestoftheCardinalHealthBoardofDirectors, have madebeen importantactively progressengaged inas awe numbernavigate ofthese areas,unprecedentedtimes, and weremainfocusedonbothstronggovernanceandlong-termvaluecreation.I wanttowill share the Board’s perspective on somethe ofyearand the changesinitiativesunderwaytocreatevalue now underwayand asCardinalHealthcontinuestopositionitselfforin the future.

SuccessfulBoardLeadershipTransitionOur Fiscal 2020 Performance

Effective at lastIn fiscal 2020, the company grew non-GAAP operating earnings and exceeded our non-GAAP diluted earnings per share guidance range. We also surpassed our enterprise cost savings target and furthered initiatives that will optimize our operations, drive sustained savings, and enable value creation for years to come. At the same time, we increased investments and partnerships in our Specialty pharmaceutical and Cardinal Health at-Home businesses, among other areas.

Additionally, the Board continued to evaluate the company’s portfolio and take a balanced and disciplined capital approach that prioritizes reinvesting in the business, maintaining a strong balance sheet and returning cash to shareholders through dividends. In fiscal 2020, we paid down $1.4 billion of debt, increased the dividend by 1%, and sold the remainder of our equity interest in naviHealth.

Our COVID-19 Response

As the global pandemic continues to unfold, we continue to be fully dedicated to the health and safety of our employees so we can fulfill our mission of delivering critical products and solutions to frontline healthcare workers around the world. We have implemented additional safety and cleaning measures in all locations, and we have maintained operations in all our distribution facilities, nuclear pharmacies, and global manufacturing plants. The Board, as well as the management team, are humbled by the efforts of our employees. We provided additional compensation to our frontline teams to demonstrate our gratitude for their unwavering commitment to our customers and to public health.

As the company responded to the challenges presented by the pandemic, the Board also transitioned to a remote work model. We are holding virtual Board meetings and this year’s Annual Meeting of Shareholders I assumedwill be virtual as well.

Our Commitment to Diversity and Inclusion

Our Chief Executive Officer, Mike Kaufmann, and our management team remain deeply committed to fostering a culture where every employee brings 100% of themselves to work every day and this includes actively facilitating conversations regarding diversity and inclusion. In the rolefall of non-executive Chairman2019, management began these discussions through an all employee meeting focused specifically on this topic, and in the winter, the team organized a group tour of the National Memorial for Peace and Justice and Legacy Museum in Montgomery, Alabama. Upon their return, Mike shared his reflections on this deeply moving experience in a message to all employees.

Following this experience, and in the aftermath of events in the U.S. throughout this spring and summer, the management team has elevated attention to racial equity and social injustice. In May, they engaged 400 vice presidents and above across the company in a frank discussion on this topic and encouraged these leaders to do the same with their teams. Mike also formed a Diversity and Inclusion Steering Council of senior leaders throughout the company to identify and discuss diversity and inclusion barriers, opportunities, and successes.

Corporate culture has been, and remains, important to the Board. To further reinforce this commitment, we embedded culture and diversity and inclusion metrics in the company’s incentive plan goals for fiscal 2020, and we are following the progress of these initiatives with regular management reports and a scorecard. The scorecard included the most recent employee engagement survey results, which showed significant improvements.

Our Board after having served as Lead Director for the prior four years. Membership

In my first year as Chairman, I worked closely withaddition, the Board itself cultivates a culture of open, direct, and respectful dialogue among our leadership team to assure that our governance practices continue to be aligned with the best interestsmembers, who bring an array of our company and shareholders. To that end, I devoted significant time and thought to utilizing the many talents and experience of the Board as we engaged with senior management on a variety of critical issues, including strategic priorities, capital deployment, operational efficiencies, the opioid epidemic and risk mitigation — all with the goal of enhancing shareholder value.

ComprehensiveReviewoftheBusiness

During fiscal 2019, the Board and management worked closely to complete a comprehensive review of the company’s portfolio, cost structure and capital deployment, which is explained in the proxy statement. The Board was actively engaged in this process, participating in extensive discussions, and continues to receive regular, detailed updates on progress.

OngoingBoardRefreshmentandCommitteeChanges

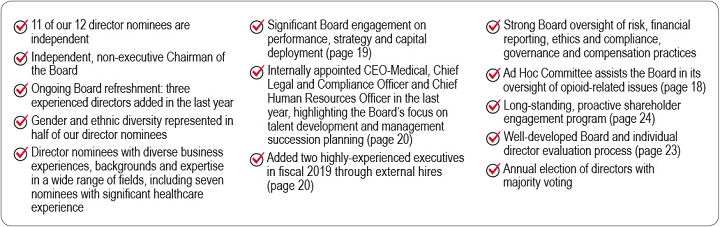

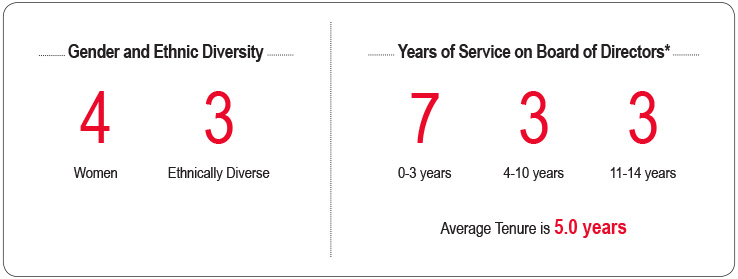

We are committed to having in place a Board of Directors with a combination of diverse skills, backgrounds, and experienceexpertise. Mike supports this culture with his open and direct engagement, including executive sessions at the beginning and end of each Board meeting. Over the years, our Board evaluation process, which includes individual director evaluations, has made important contributions to support the company’s evolving businessBoard culture and strategic directionthis year, to continuously evolve this process, we used a new facilitator to gain additional insights regarding our strengths and improvement opportunities.

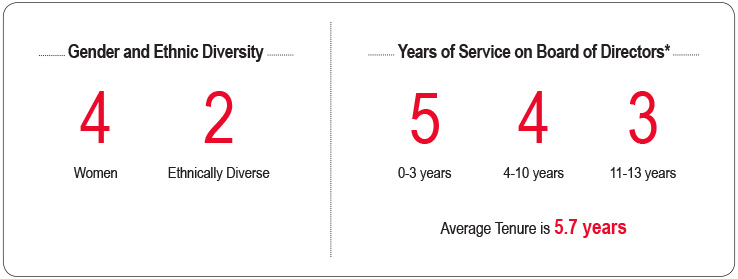

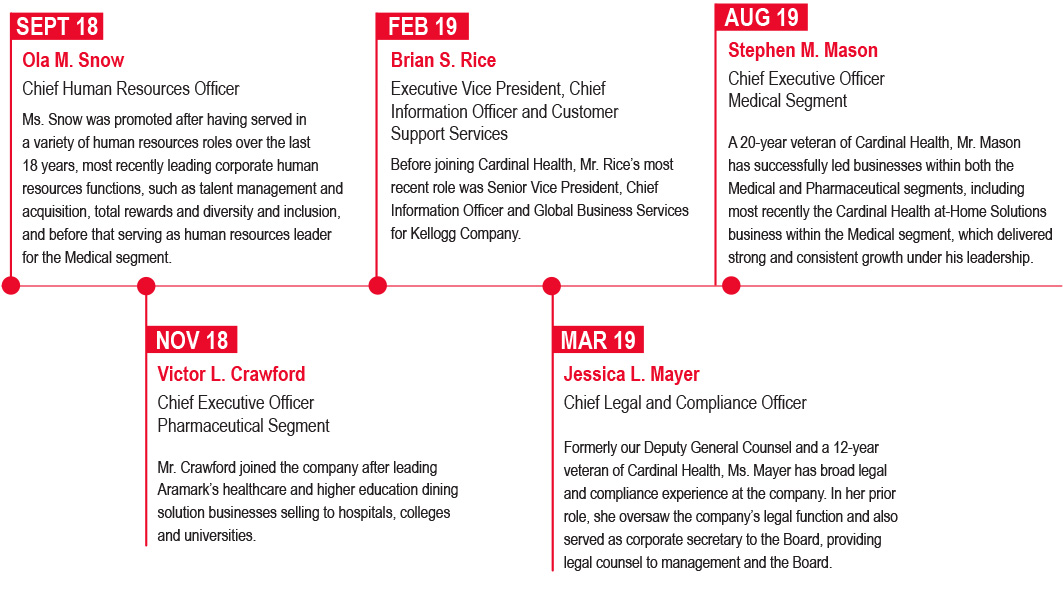

We also continue to fulfill our oversight responsibilities. To that end,evolve this culture as we have continued to refresh our Board membership and are pleased to havemembership. This year, we added threetwo new directors over the past year.

Last December, we welcomed back former Cardinal Health director Mike Losh to a new termfurther diversify our expertise and perspectives. Our most recent addition was Sheri Edison, who joins with extensive global experience both as a director. Mike,senior legal executive in the medical device and global packaging industries and as a board member for large for-profit and non-profit organizations. Earlier this summer, we also welcomed Dave Evans, who previously served as Chief Financial Officer of General Motors,Scotts Miracle-Gro for many years and brings deep financial experience, as well as valuable insights due to his experience with our company. With his extensive financial and leadership background, he was able to immediately assume the important responsibility of chairing our Audit Committee. We are fortunate to benefit from his decades of experience and extensive public company board leadership expertise.financial experience.

As of September 1st, we have added two more independent directors: Dean Scarborough and John Weiland. Dean was Chairman and Chief Executive Officer of Avery Dennison and brings toIn addition, Colleen Arnold is leaving the Board experience in manufacturing and distribution, as well as a global perspective. John was President and Chief Operating Officer of medical device maker C. R. Bard and brings over 40after years of healthcare industry experiencevaluable service. On behalf of the full Board, I would like to thank her for her many contributions, including her leadership regarding the Board. We are very pleased to welcome these two talented former executives who bring a wealthcompany’s strategic use of businessinformation and industry experience, as well as experience serving on other public company boards. technology, and we wish her well.

These appointmentschanges will bring the total number of Cardinal Health directors to 13, 12 11 of whom are independent.

The Board also made important new appointments

Cardinal Health | 2020 Proxy Statement 1 |

Back to committee leadership. Carrie Cox succeeded Dave King as Chair ofContents

Our Ongoing Response to the Human Resources and Compensation Committee and Pat Hemingway Hall succeeded me as Chair ofOpioid Epidemic

I will briefly address our ongoing work regarding the Nominating and Governance Committee.

BoardOversightandtheOpioidEpidemic

opioid epidemic. The Board and the company care deeply aboutcontinue to recognize the significant challenges that opioid epidemic and take seriously our commitment, in cooperation with other participants in the pharmaceutical supply chain, to find and support solutions to this national challenge. As a distributor and an intermediary in the supply chain, Cardinal Health has an important but limited and specific role — which is, to provide a secure channel to deliver medications from manufacturersmisuse presents to our thousands of hospitalsociety, and pharmacy customers licensedthe company remains vigilant in our work to dispense them to patients,detect and to work diligently to identify, stop and report to regulators suspicious ordersdeter diversion of controlled substances.

The Board has been and remainsour Ad Hoc Committee on opioids is active in overseeing Cardinal Health’s responsethe company’s anti-diversion work as well as the company’s efforts to defend and resolve opioid litigation.

Last October, the company agreed in principle to a global settlement framework with a group of state attorneys general that aims to resolve all pending and future opioid lawsuits by states and political subdivisions. This settlement framework would deliver important resources to the opioid epidemic.communities that need them most. The Board’scompany, with oversight of our Ad Hoc Committee of independent directors assistsand the Board, in its oversight of opioid-related issues, continues to meet regularly and reports at every Board meeting. Asbe active in settlement discussions.

Looking Forward

In fiscal 2020, we demonstrated our adaptability in the opioid litigation moves closer to the first scheduled trial date in October, the Ad Hoc Committee will continue to be actively engaged, overseeingface of unprecedented change. Going forward, our efforts to vigorously defend ourselves and the discussions about possible litigation resolutions. In addition, we continue to monitor the business and reputational impacts stemming from the epidemic and the surrounding litigation.

ThankYou

I believe that we have a strong, engaged Board, of Directorsour strong management team, and onour dedicated employees are well-positioned to build upon our operational momentum. On behalf of our Board, I thank you for your share ownership in Cardinal Health and for your continued support of the company. I look forwardTogether, we will enable Cardinal Health to continuingperform our ongoingessential role in healthcare now and active dialogue.into the future.

Sincerely,

Gregory B. Kenny

Chairman of the Board

Cardinal Health |

www.cardinalhealth.com | Cardinal Health | 2020 Proxy Statement 2 |

Notice of Annual Meeting of Shareholders

Wednesday, November 6, 2019

8:00a.m.EasternTime

CardinalHealth,Inc.

7000 Cardinal Place

Dublin, Ohio 43017

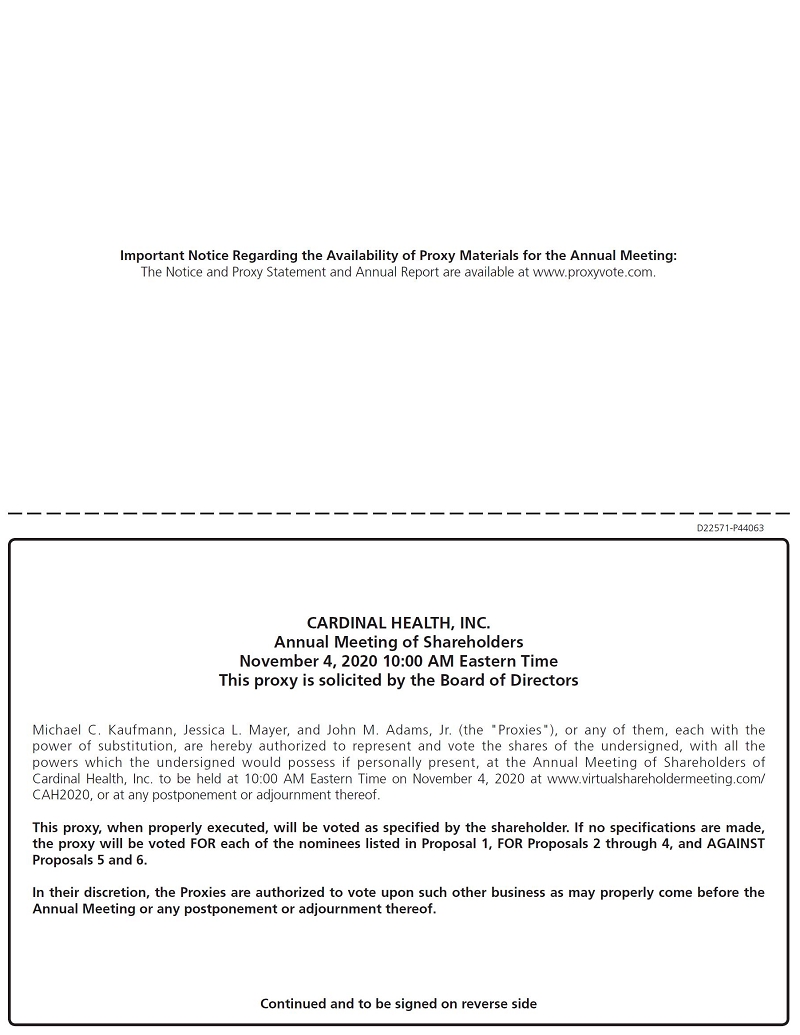

Important notice regardingDue to the availabilitypublic health impact of proxy materials for the coronavirus (“COVID-19”) pandemic and to support the health and well-being of our employees and shareholders, this year’s Annual Meeting of Shareholders (“Annual Meeting”) will be conducted exclusively online without an option for physical attendance. You will be able to be held on November 6, 2019:participate in the virtual meeting online, vote your shares electronically, and submit questions during the meeting by visiting www.virtualshareholdermeeting.com/CAH2020.

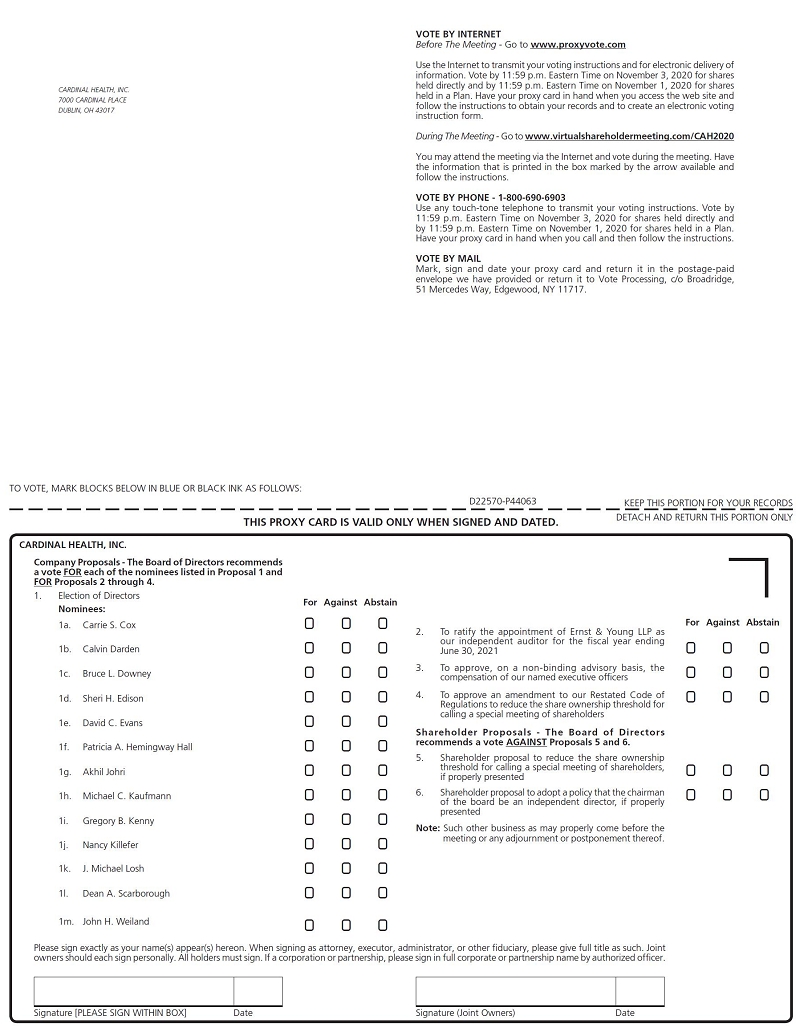

Date | Wednesday, November 4, 2020 | |

Time | 10:00 a.m. Eastern Time | |

VirtualMeeting | This year’s meeting is a virtual shareholder meeting at www.virtualshareholdermeeting.com/CAH2020. | |

RecordDate | September 8, 2020. Only shareholders of record at the close of business on the record date are entitled to receive notice of, and to vote at, the Annual Meeting. | |

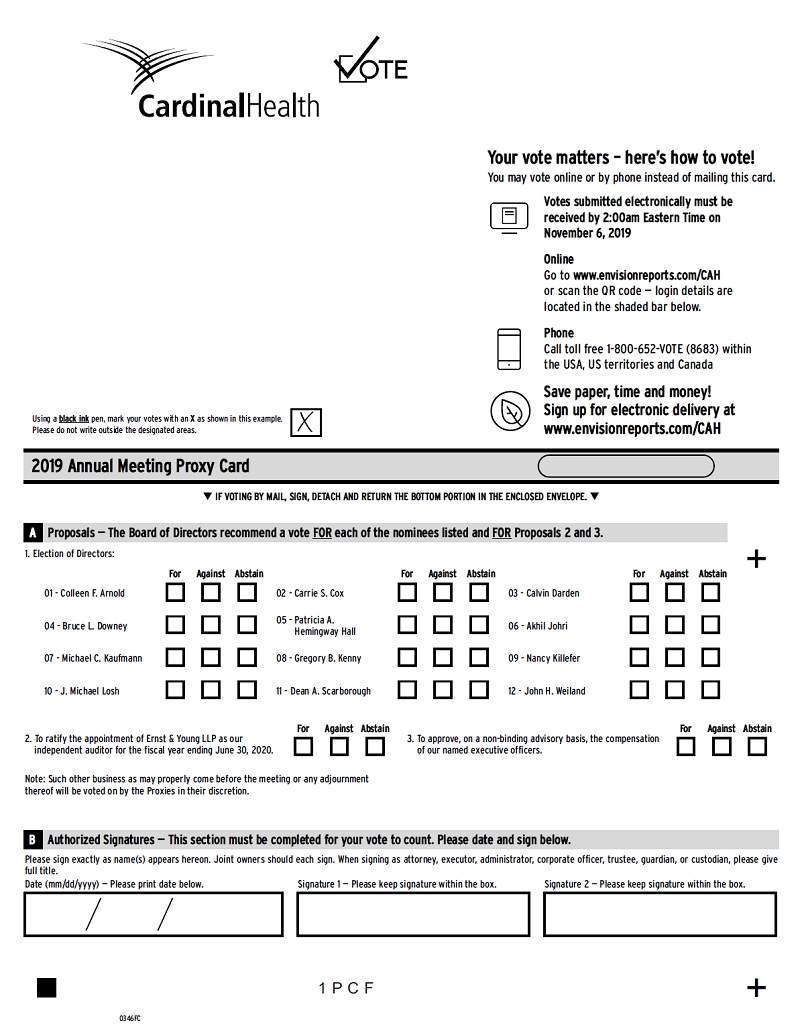

ProxyVoting | Makeyourvotecount. Please vote your shares promptly to ensure the presence of a quorum during the Annual Meeting. Voting your shares now via the Internet, by telephone, or by signing, dating, and returning the enclosed proxy card or voting instruction form will save the expense of additional solicitation. If you wish to vote by mail, we have enclosed an addressed envelope with postage prepaid if mailed in the United States. Submitting your proxy now will not prevent you from voting your shares during the Annual Meeting, as your proxy is revocable at your option. We are requesting your vote to: | |

Items of Business | (1) Elect the 13 director nominees named in the proxy statement; (2) Ratify the appointment of Ernst & Young LLP as our independent auditor for the fiscal year ending June 30, 2021; (3) Approve, on a non-binding advisory basis, the compensation of our named executive officers; (4) Approve an amendment to our Restated Code of Regulations to reduce the share ownership threshold for calling a special meeting of shareholders; (5) Vote on two shareholder proposals described in the accompanying proxy statement, if properly presented at the meeting; and (6) Transact such other business as may properly come before the meeting or any adjournment or postponement. | |

MeetingDetails | See “Proxy Summary” and “Other Matters” for details. |

ImportantnoticeregardingtheavailabilityofproxymaterialsfortheAnnualMeetingtobeheldonNovember4,2020: The Notice of Annual Meeting of Shareholders, the accompanying proxy statement and our fiscal 20192020 Annual Report to Shareholders are available at www.edocumentview/cah.www.proxyvote.com. These proxy materials are first being sent or made available to shareholders commencing on September 20, 2019.

To vote on the following proposals:

To elect the 12 director nominees named in the proxy statement;[ ], 2020.

To ratify the appointment of Ernst & Young LLP as our independent auditor for the fiscal year ending June 30, 2020;

To approve, on a non-binding advisory basis, the compensation of our named executive officers; and

To transact such other business as may properly come before the meeting or any adjournment or postponement.

Shareholders of record at the close of business on September 9, 2019 are entitled to notice of, and to vote at, the meeting or any adjournment or postponement.

By Order of the Board of Directors.

September 20, 2019

JohnM.Adams,Jr.

Senior Vice President, Associate General Counsel and SecretarVicePresident,yAssociateGeneralCounselandSecretarySeptember [ ], 2020

Cardinal Health | |

This summary highlights certain information contained elsewhere in our proxy statement. This summary does not contain all the information that you should consider, and you should carefully read the entire proxy statement and our fiscal 20192020 Annual Report to Shareholders before voting. References to our fiscal years in the proxy statement mean the fiscal year ended or ending on June 30 of such year. For example, “fiscal 2019”2020” refers to the fiscal year ended June 30, 2019.2020.

Headquartered in Dublin, Ohio, we are a global integrated healthcare services and products company providing customized solutions for hospitals, healthcare systems, pharmacies, ambulatory surgery centers, clinical laboratories, physician offices and physician offices.patients in the home. We providedistribute pharmaceuticals and medical products and pharmaceuticals andprovide cost-effective solutions that enhance supply chain efficiency from hospital to home.efficiency. We connect patients, providers, payers, pharmacists and manufacturers for integrated care coordination and better patient management. We manage our business and report our financial results in two segments: Pharmaceutical and Medical.

Fiscal 2019 was a year of progress for Cardinal Health. We deliveredDuring fiscal 2020, we grew non-GAAP operating earnings, exceeded our non-GAAP diluted earnings per share (“EPS”) guidance range, surpassed our enterprise cost savings target, and strengthened our balance sheet, all while continuing to execute on our overall goalslong-term strategic priorities in a rapidly changing environment.

We achieved fiscal 2020 results as we adapted our operations to address the unique challenges presented by COVID-19. In response to the pandemic, we continued to maintain operations in all our distribution facilities, nuclear pharmacies and made significant stridesglobal manufacturing plants and successfully transitioned our office employees to a remote work model. Through all of this, our focus remained on key strategic initiatives.delivering critical products and services to our customers, while protecting the health and safety of our employees.

Fiscal 2019 performance2020 highlights include:

Revenue was $145.5 billion.$152.9 billion, up 5% from the prior year.

GAAP operating earnings were $2.1loss was $(4.1) billion due to an opioid litigation charge and non-GAAP operating earnings were $2.4 billion.billion, a 1% increase over the prior year. Non-GAAP operating earnings grew despite an estimated net negative impact of approximately $100 million from COVID-19.

GAAP diluted earnings per share (“EPS”) were $4.53 and non-GAAP EPS were $5.28.

Operating cash flow was $2.7 billion.

Returned $1.2 billionWe returned over $900 million to shareholders including $600 million in dividends ($569 million) and share repurchases ($350 million) and $577 million in dividends.

Repaid $1.1repaid $1.4 billion of long-term debt.

Our Pharmaceutical segment revenue was $129.9segment’s performance exceeded our expectations. Revenue grew 6% to $137.5 billion. Segment profit decreased 4% to $1.8 billion, and segment profit was $1.8 billion.reflecting the expected adverse impact of Pharmaceutical Distribution customer contract renewals.

Our Medical segmentsegment’s revenue was $15.6decreased 1% percent to $15.4 billion due to the adverse impact from COVID-19. Segment profit increased 15% to $663 million largely due to cost savings and segment profit was $576 million.the favorable year-over-year impact of a supplier charge taken last year, partially offset by the negative impact of COVID-19.

Realized annualWe surpassed our enterprise cost savings of over $130 million in fiscal 2019 through cost optimization initiatives.

Other highlights fortarget, with significant savings contributions from the fiscal year include:

Renewed our contracts with CVS HealthMedical segment’s global manufacturing and Kroger for at least the next four years.supply chain organization.

FinalizedWe completed the divestiture of our successful investment in naviHealth.

We agreed in principle to a partnershipglobal settlement framework designed to resolve all opioid lawsuits and claims by states and political subdivisions and continue to work with Clayton, Dubilier & Ricestate attorneys general and representatives of political subdivisions to jointly invest in naviHealthachieve a global settlement.

Our generic pharmaceuticals program performed better than expected with a slight favorable impact on Pharmaceutical segment profit after several years of a negative impact.

We launched “Our Path Forward” outlining the plans and accelerate its growth.initiatives underway to advance our corporate culture objectives. We added new culture goals to our annual cash incentive and performance share unit (“PSU”) programs.

See Annex A for reconciliations to the comparable financial measures prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) and the reasons why we use non-GAAP financial measures.

www.cardinalhealth.com | Cardinal Health | 2020 Proxy Statement 4 |

As a global manufacturer and distributor of medical and laboratory supplies and a distributor of pharmaceutical products, we are an essential and critical link in the healthcare supply chain. During the COVID-19 pandemic, our mission has been more important than ever as we have worked to quickly get critical medicines and medical supplies into the hands of our healthcare provider customers who need them.

Given the unprecedented surge in demand for certain personal protective equipment (“PPE”), supporting delivery of these critical products has been a priority, and we continue to work to address the increased demand. In furtherance of this goal, we worked with U.S. and foreign trade authorities to speed shipments of product, we acquired additional equipment to expand our own production of PPE, and we evaluated additional suppliers to expand and diversify critical product options.

Protecting the health and safety of our employees and their families throughout this pandemic has been vital. Because we are part of a critical infrastructure industry, our employees have continued their important work in our distribution centers, manufacturing sites, pharmacies and other clinical sites. Their efforts have been essential to the healthcare system.

To prevent the spread of COVID-19 and protect the safety of our critical frontline employees, all facilities are thoroughly cleaned regularly, and we have implemented worksite hygiene practices in accordance with the Centers for Disease Control and Prevention and World Health Organization guidelines. And to recognize the important contributions made by our frontline employees, we provided them additional compensation.

All employees who have been able to work remotely have been working from home. We expanded our technology infrastructure to help our employees around the globe perform their duties and continue to support customers, patients and our frontline associates. We also put policies in place to allow employees who are sick with or who have been exposed to COVID-19 to take time off without impacting their paid-time-off days.

Our Board of Directors (“Board”) has been highly engaged with management about the impact of COVID-19 and the company’s response and plans. The Board has held regular informational calls with management about COVID-19, covering employees and operations, financial impact, product supply, media engagement, and related legal and regulatory matters.

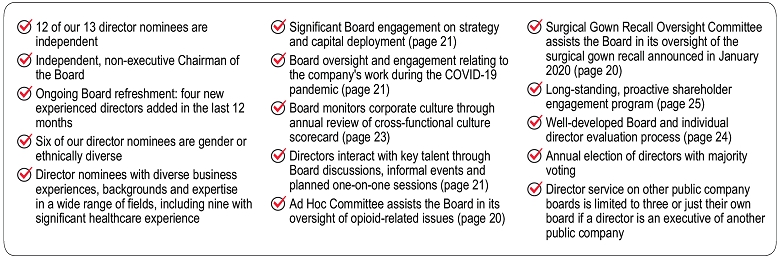

Governance and Board Highlights

Cardinal Health |2019 Proxy Statement3

Cardinal Health | 2020 Proxy Statement 5 |

|  |  |  |  |

| Carrie S. Cox | Calvin Darden | Bruce L. Downey | Sheri H. Edison | |

| Retired EVP and President, Global Pharmaceuticals, Schering-Plough and retired Chairman and CEO, Humacyte, Inc. Age: 62 Director since2009 Independent Committees: H, AH | Retired SVP of U.S. Operations, UPS Age: Director since2005 Independent Committees: H, AH | Retired Chairman and CEO, Barr Pharmaceuticals and Partner, NewSpring Health Capital II, L.P. Age: Director since2009 Independent Committees: N, AH | EVP and General Counsel, Amcor Age: 63 Director since 2020 Independent | |

|  |  |  |  |

| David C. Evans | Patricia A. Hemingway Hall | Akhil Johri | ||

| Retired CFO, Scotts Miracle-Gro and Battelle Memorial Institute Age: 57 Director since 2020 Independent | Retired President and CEO, Health Care Service Corp. Age: Director since2013 Independent Committees: H, N | Retired EVP and CFO, United Technologies Age: Director since2018 Independent Committees: A, S | ||

|  |  | ||

| Michael C. Kaufmann | Gregory B. Kenny | Nancy Killefer | ||

| CEO, Cardinal Health Age: Director since2018 | Retired President and CEO, General Cable Age: Director since2007 Independent Chairman of the Board Committees: N, AH, S | Retired Senior Partner, Public Sector Practice, McKinsey Age: 66 Director since 2015 Independent Committees: H, S | ||

|  |  |  | |

| J. Michael Losh | Dean A. Scarborough | John H. Weiland | ||

| Retired EVP and CFO, General Motors Age: Director since2018 Independent Committees: A | Retired Chairman and CEO, Avery Dennison Age: Director since2019 Independent Committees: A | Retired President and Chief Operating Officer, C. R. Bard Age: Director since2019 Independent Committees: A, S |

A: Audit AH: Ad Hoc N: Nominating and Governance H: Human Resources and Compensation N: Nominating and Governance S: Surgical Gown Recall Oversight

www.cardinalhealth.com | Cardinal Health | |

Addressing the Opioid Epidemic

We care deeply about the opioid epidemic and take seriously our commitment, in cooperation with other participants in the prescription drug supply chain, to find and support solutions to this national challenge.

As a distributor and an intermediary in the supply chain, we play an important, but limited and specific role: we provide a secure channel to deliver all kinds of medications from the hundreds of manufacturers that make them to ourthe thousands of our hospital and pharmacy customers licensed to dispense them to their patients, and we work diligently to identify, stop and report to regulators any suspicious orders of controlled substances. As threats evolve, we constantly adapt our system to prevent the diversion and misuse of medications.

In October 2019, following review and extensive engagement with both the Ad Hoc Committee and the Board, we agreed in principle with a leadership group of state attorneys general to a global settlement framework designed to resolve all pending and future opioid lawsuits and claims by states and political subdivisions.

We remain committed to being part of the solution to this epidemic, and we continue to actively work with the state attorneys general and representatives of political subdivisions to achieve a global settlement.

The Board has been and remains active in overseeing our response to the opioid epidemic. The Board’s Ad Hoc Committee comprised of independent directors Cox, Darden, Downey and Kenny assists the Board in its oversight of opioid-related issues. The Ad Hoc Committee, which was formed in February 2018, continues to meet twice per quarter and engage with the other directors on opioid-related issues at every Board meeting.

As the first scheduled trial date (October 2019) in the opioid litigation approaches, theThe Ad Hoc Committee is receiving regular updates on progress toward a global settlement as well as updates on the current status of the litigation and discussions of possible litigation resolutions and is monitoring the business and reputational impacts. The Ad Hoc Committee also has received updates ongovernment investigations, our anti-diversion program, legislative and regulatory developments, and shareholder engagement and developments in our Opioid Action Program.engagement.

We useare always vigilant in combating the diversion of controlled substances for improper use. We have continually upgraded our program to make sure it is robust and effective in a multi-factor process tocontext of evolving risks. Our team includes investigators, data analysts, former law enforcement officers, pharmacists, and compliance officers.

We carefully evaluate pharmacies before they become customers, including taking steps to understand their business and historical prescription drug ordering patterns. Controlled substance orders pass through ourWe use this information, along with statistical models and other criteria, to establish pharmaceutical distribution thresholds specific to each customer. When a customer’s order monitoring system, which tracks orders against statistical benchmarks for signs of potential diversion. Ifexceeds an established threshold, the order is deemed suspicious, it is canceledheld, reviewed further, and typically canceled. Canceled orders are reported to the U.S. Drug Enforcement Administration (“DEA”) and applicableany required state regulators. We also have a team of experienced investigators who regularly conduct customerregular site visits both announcedto customers across the country to look for any visible signs of diversion.

Our Efforts to Fight Prescription Opioid Misuse

We have invested millions of dollars in fighting prescription opioid misuse. This work began with Generation Rx, an evidence-informed prevention education and unannounced. Finally, we have a committeeawareness program designed for anyone to use to educate people of senior anti-diversionall ages about safe medication practices and regulatory experts that meets regularly to evaluate customers with higher-volume controlled substance orders.

Our anti-diversion program includes constantly adaptive, rigorous systems. Recent updates include access to the DEA database known as “ARCOS” that collects data around the flowpotential dangers of controlled substances through the supply chain and system and process enhancements to comply with a recently enacted Ohio rule.

Opioid Action Program andmisusing prescription medications. Generation Rx

As part was founded at The Ohio State University College of our Opioid Action Program launched in 2017,Pharmacy and has partnered with the Cardinal Health Foundation recentlysince 2009. To date, its medication safety messages have reached more than two million people across the country.

In the last three years, we have awarded nearly $1 million in additional grants to state pharmacy associationsmore than 70 organizations to build awareness, expand drug takeback initiatives, and collegessupport healthcare systems as they work to reduce the number of pharmacy to support best strategies for prescribing practices. Other activities during fiscal 2019 included hosting the recipients of our 2018 “Best Practices in Opioid Prescribing” grants, pain management experts and other healthcareopioids their providers at a two-day symposium in Central Ohio, to discuss best practices, successes and challenges in managing pain with fewer prescribed opioids. Also, during the fiscal year, weprescribe. We have partnered with Kroger onto host biannual drug take-back events at more than 200 local pharmacy locations across the country. And we launched an online training for all U.S. employees to help them better understand the epidemic, our commitment to fighting it, and how they can support the work.

Cardinal Health also has been a leader in pioneering and supporting impactful prevention and education programs to combat opioid abuse under the umbrella of Generation Rx, a national program developed by the Cardinal Health Foundation and The Ohio State University College of Pharmacy. This year marks the 10th anniversary of Generation Rx, which has more than 100 pharmacy school chapters.

Cardinal Health | 2020 Proxy Statement 7 |

Cardinal Health |2019 Proxy Statement5

Attending theVirtual Annual Meeting of Shareholders

See page 52

Time and Date Wednesday, November 4, 2020 10:00 a.m. Eastern Time Place Virtual Meeting www.virtualshareholdermeeting.com/CAH2020 Record Date September 8, 2020

Due to COVID-19, this year’s Annual Meeting will be conducted exclusively online without an option for instructionsphysical attendance. You will be able to participate in the virtual Annual Meeting online, vote your shares electronically, and submit questions during the meeting by visiting www.virtualshareholdermeeting.com/CAH2020 and entering the 16-digit control number included in the Notice of Internet Availability of Proxy Materials, voting instruction form or proxy card that was sent to you with this proxy statement.

If you do not have a 16-digit control number, you may still attend the meeting as a guest in listen-only mode. To attend as a guest, please visit www.virtualshareholdermeeting.com/CAH2020 and enter the information requested on the screen to register as a guest. Please note that you will not have the ability to vote or ask questions during the meeting if you participate as a guest.

For further information on how to gain admission to Cardinal Health’s 2019attend and participate in the virtual Annual Meeting, of Shareholders (the “Annual Meeting”).please see “Other Information” on page 58 in this proxy statement.

Shareholders will be asked to vote on the following proposals at the Annual Meeting:

Proposal | Board Recommendation | Page Reference |

Proposal 1: to elect the | FOR each director nominee |

|

Proposal 2: to ratify the appointment of Ernst & Young LLP as our independent auditor for the fiscal year ending June 30, | FOR |

|

Proposal 3: to approve, on a non-binding advisory basis, the compensation of our named executive officers | FOR |

|

Proposal4:to approve an amendment to our Restated Code of Regulations to reduce the share ownership threshold for calling a special meeting of shareholders | FOR | 52 |

Proposal5: shareholder proposal to reduce the share ownership threshold for calling a special meeting of shareholders | AGAINST | 53 |

Proposal6:shareholder proposal to adopt a policy that the chairman of the board be an independent director | AGAINST | 54 |

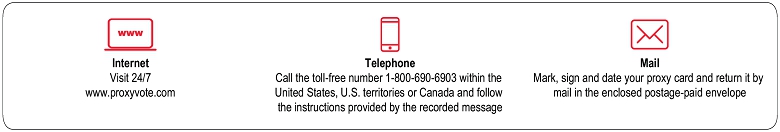

How to Vote in Advance of the Annual Meeting

You can return voting instructions in advance of the Annual Meeting by any of the means set forth below. Internet or telephone voting is available until Wednesday, November 3, 2020 at 11:59 p.m. Eastern Time.

Internet Visit 24/7 www.proxyvote.com Telephone Call the toll-free number 1-800-690-6903 within the United States, U.S. territories or Canada and follow the instructions provided by the recorded message Mail Mark, sign and date your proxy card and return it by mail in the enclosed postage-paid envelope

www.cardinalhealth.com | Cardinal Health | |

Election of Directors

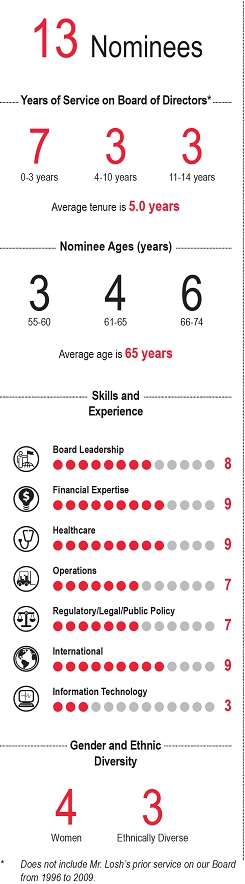

TheOur Board currently has nominated 1214 members. Thirteen of our directors are standing for election at the Annual Meeting to serve until the next Annual Meeting of Shareholders and until their successor is duly elected and qualified. qualified or until their earlier resignation, removal from office or death. Colleen F. Arnold, a director since 2007, has decided not to stand for re-election at the Annual Meeting. The size of the Board will be reduced to 13 at that time.

Each director nominee agreed to be named in this proxy statement and to serve if elected. If, due to death or other unexpected occurrence, one or more of the director nominees is not available for election, proxies will be voted for the election of any substitute nominee the Board selects.

| The Board recommends that you vote FOR the election of the nominees listed on pages |

Board Membership Criteria: What we look for

The Nominating and Governance Committee considers and reviews with the Board the appropriate skills and characteristics for Board members in the context of the Board’s current composition and objectives. Criteria for identifying and evaluating candidates for the Board include:

business experience, qualifications, attributes and skills, such as relevant industry knowledge (including pharmaceutical, medical device and other healthcare industry knowledge), accounting and finance, operations, technology and international markets;

leadership experience as a chief executive officer, senior executive or leader of a significant business operation or function;

financial and accounting experience as a chief financial officer;

independence (including independence from the interests of any single group of shareholders);

judgment and integrity;

ability to commit sufficient time and attention to the activities of the Board;

diversity of age, gender and ethnicity; and

absence of potential conflicts with our interests.

The Board seeks members that possess the experience, skills and diverse backgrounds to perform effectively in overseeing our current and evolving business and strategic direction and to properly perform the Board’s oversight responsibilities. All of our director nominees bring to the Board a wealth of executive leadership experience derived from their diverse professional backgrounds and areas of expertise. As a group, they have business acumen, healthcare and global business experience and financial expertise, as well as public company board experience. EachIn addition, six of ourthe thirteen director nominees are gender or ethnically diverse. Each director nominee has sound judgment and integrity and is able to commit sufficient time and attention to the activities of the Board. All director nominees other than our Chief Executive Officer are independent.

Cardinal Health | 2020 Proxy Statement 9Cardinal Health |2019 Proxy Statement7

|

| ||

| |||

| |||

| |||

| |||

| |||

| |||

|

| ||

Age 62

Director since 2009

Board Human Resources and Compensation, Ad Hoc

Independent Director |

| CARRIE S. COX | |

Executive Vice President and President of Global Pharmaceuticals, Schering-Plough Corporation (retired); Chairman and Chief Executive Officer of Humacyte, Inc. (retired) | |||

Background | |||

Ms. Cox served as Chairman and Chief Executive Officer of Humacyte, Inc., a privately held, development stage company focused on regenerative medicine, from 2010 to 2018 and as its Executive Chairman from 2018 to 2019. She was Executive Vice President and President of Global Pharmaceuticals at Schering-Plough Corporation, a multinational branded pharmaceutical manufacturer, from 2003 until its merger with Merck & Co. in 2009. She was Executive Vice President and President of the Global Prescription | |||

Qualifications | |||

Through her roles as an executive of Schering-Plough, President of Pharmacia’s Global Prescription business and Chief Executive Officer of Humacyte and as a licensed pharmacist, Ms. Cox brings to the Board substantial expertise in healthcare, particularly the branded pharmaceutical and international aspects. She draws on this experience in discussions relating to Pharmaceutical segment strategy, healthcare compliance and the opioid epidemic, including in meetings of the Board’s Ad Hoc Committee. Ms. Cox worked in the global branded pharmaceutical industry for over 30 years, giving her relevant experience with large, multinational healthcare companies in the areas of regulatory compliance, global markets and manufacturing operations. She also brings to the Board and to her role chairing our Human Resources and Compensation Committee, valuable perspectives and insights from her service on the boards of directors of | |||

Other public company boards | |||

Current

Texas Instruments Incorporated | Within last five years Array BioPharma Inc. Celgene Corporation electroCore, Inc. | ||

Age

Director since 2005

Board Human Resources and Compensation, Ad Hoc

Independent Director |

| CALVIN DARDEN | |

Senior Vice President of U.S. Operations of United Parcel Service, Inc. (retired) | |||

Background | |||

Mr. Darden was Senior Vice President of U.S. Operations of United Parcel Service, Inc. (“UPS”), an express carrier and package delivery company, from 2000 until 2005. During his 33-year career with UPS, he served in a number of senior leadership positions, including developing the corporate quality strategy for UPS and leading the business and logistics operations for its Pacific Region, the largest region of UPS at that time. | |||

Qualifications | |||

A former executive of UPS, Mr. Darden has expertise in supply chain networks and logistics that contributes to the Board’s understanding of these important aspects of our business. He has over 30 years of relevant experience in the areas of operations, distribution and supply chain, efficiency and quality control, human resources and labor relations. He also brings to the Board valuable perspectives and insights from his service on the boards of directors of Aramark and Target, including their respective Compensation Committees, as well as his prior service on the board of directors of Coca-Cola Enterprises, including service on its Human Resources and Compensation Committee. | |||

Other public company boards | |||

Current Aramark Corporation Target Corporation | Within last five years Coca-Cola Enterprises, Inc. | ||

www.cardinalhealth.com | Cardinal Health | 2020 Proxy Statement 10 |

Age

Director since 2009

Board Nominating and Governance, Ad Hoc

Independent Director |

| BRUCE L. DOWNEY | |

Chairman and Chief Executive Officer of Barr Pharmaceuticals, Inc. (retired); Partner of NewSpring Health Capital II, L.P. | |||

Background | |||

Mr. Downey was Chairman and Chief Executive Officer of Barr Pharmaceuticals, Inc., a global generic pharmaceutical manufacturer, from 1994 until 2008 when the company was acquired by Teva Pharmaceutical Industries Ltd. Mr. Downey has served on a part-time basis as a Partner of NewSpring Health Capital II, L.P., a venture capital firm, since 2009. Before his career at Barr Pharmaceuticals, Mr. Downey was a practicing attorney for 20 years, having worked in both private practice and with the U.S. Department of Justice. | |||

Qualifications | |||

Having spent 14 years as Chairman and Chief Executive Officer of Barr Pharmaceuticals, Mr. Downey brings to the Board substantial global experience in the areas of healthcare, regulatory compliance, manufacturing operations, finance, human resources and corporate governance. He offers valuable experience in the pharmaceutical and international aspects of our businesses, and he draws on his extensive legal and healthcare experience in chairing the Ad Hoc Committee and leading Board discussions related to opioid litigation and the opioid epidemic. Mr. Downey also brings to the Board valuable perspectives and insights from his service on the | |||

Other public company boards | |||

Current Momenta Pharmaceuticals, Inc. | Withinlastfiveyears Melinta Therapeutics, Inc. | ||

Age 63 Director since September 2020 Board Committees: Not yet determined Independent Director | SHERI H. EDISON | ||

Executive Vice President and General Counsel of Amcor plc | |||

Background | |||

Ms. Edison has served as Executive Vice President and General Counsel of Amcor plc, a global packaging company, since 2019. Prior to that, she served as Senior Vice President, Chief Legal Officer and Secretary of Bemis Company, Inc., also a global packaging company, from 2017 until Bemis was acquired by Amcor in 2019. Ms. Edison had also served as Vice President, General Counsel and Secretary of Bemis from 2010 to 2016. She came to Bemis from Hill-Rom Holdings Inc., a global medical device company, where she had served as Senior Vice President and Chief Administrative Officer from 2007 to 2010 and Vice President, General Counsel and Secretary from 2004 to 2007. Ms. Edison began her career in private legal practice. | |||

Qualifications | |||

Having served in general counsel roles at publicly traded manufacturing companies in industries such as medical devices and packaging, Ms. Edison brings to the Board substantial experience in the areas of healthcare, legal, regulatory compliance, corporate governance and international markets. She also brings prior private legal practice experience, which further bolsters her understanding of a dynamic legal and regulatory environment. Ms. Edison also brings to the Board valuable perspectives and insights from her former service on the board of directors of AK Steel. | |||

Other public company boards | |||

Current None | Withinlastfiveyears AK Steel Holding Corporation | ||

Cardinal Health | 2020 Proxy Statement 11 |

Age 57 Director since July 2020 Board Committees: Not yet determined Independent Director | DAVID C. EVANS | ||

Chief Financial Officer of The Scotts Miracle-Gro Company and Battelle Memorial Institute (retired) | |||

Background | |||

Mr. Evans was Executive Vice President and Chief Financial Officer of Battelle Memorial Institute, a private research and development organization, from 2013 to 2018. Prior to that, he was Chief Financial Officer of The Scotts Miracle-Gro Company, a consumer lawn and garden products company, from 2006 until 2013 and Executive Vice President, Strategy and Business Development of Scotts from 2011 until 2013. In all, he spent 20 years in various managerial roles at Scotts. Most recently, Mr. Evans was Cardinal Health’s interim Chief Financial Officer from September 1, 2019 through May 25, 2020, after a transition role beginning July 29, 2019. | |||

Qualifications | |||

We elected Mr. Evans to the Board based on his deep financial background as Chief Financial Officer at Scotts Miracle-Gro and Battelle. Having spent 25 years in financial leadership positions with these organizations, Mr. Evans brings to the Board substantial experience in the areas of finance and accounting, investor relations, capital markets, strategy, tax and information technology. He also provides valuable insights in the areas of financial reporting and internal controls. Through his experience with Scotts Miracle-Gro, he provides a deep understanding of the financial aspects of, and capital deployment for, a publicly traded company. His service in an interim executive role at Cardinal Health brings company and industry knowledge to the Board. Mr. Evans also brings valuable perspectives and insights from his service on the board of directors of Scotts Miracle-Gro, including service on its Audit and Compensation and Organization Committees. | |||

Other public company boards | |||

Current The Scotts Miracle-Gro Company | Within last five years None | ||

Cardinal Health |2019 Proxy Statement9

Age

Director since 2013

Board Human Resources and Compensation, Nominating and Governance

Independent Director |

| PATRICIA A. HEMINGWAY HALL | |

President and Chief Executive Officer of Health Care Service Corporation (retired) | |||

Background | |||

Ms. Hemingway Hall served as President and Chief Executive Officer of Health Care Service Corporation, a mutual health insurer (“HCSC”), from 2008 until 2016. Previously, she held several executive leadership positions at HCSC, including President and Chief Operating Officer from 2007 to 2008 and Executive Vice President of Internal Operations from 2006 to 2007. | |||

Qualifications | |||

As retired President and Chief Executive Officer of HCSC, the largest | |||

Other public company boards | |||

Current

Halliburton Company ManpowerGroup Inc. | Within last five years

| ||

www.cardinalhealth.com | Cardinal Health | 2020 Proxy Statement 12 |

Age

Director since 2018

Board Audit, Surgical Gown Recall Oversight

Independent Director |

| AKHIL JOHRI | |

Executive Vice President and Chief Financial Officer, United Technologies Corporation (retired) | |||

Background | |||

Mr. Johri | |||

Qualifications | |||

Having spent more than 25 years in financial leadership positions with UTC and Pall Corporation, Mr. Johri brings to the Board substantial experience in the areas of global finance and accounting, investor relations, capital markets, mergers and acquisitions, tax, information technology and international markets. | |||

Other public company boards | |||

Current

| Within last five years None | ||

Age

Director since 2018 |

| MICHAEL C. KAUFMANN | |

Chief Executive Officer, Cardinal Health, Inc. | |||

Background | |||

Mr. Kaufmann has served as Chief Executive Officer of Cardinal Health since January 2018. From November 2014 to December 2017, he served as our Chief Financial Officer and from August 2009 to November 2014, he served as our Chief Executive Officer — Pharmaceutical Segment. Prior to that, he held a range of other senior leadership roles here spanning operations, sales and finance, including in both our Pharmaceutical and Medical segments. | |||

Qualifications | |||

As our Chief Executive Officer and having spent almost 30 years at Cardinal Health, Mr. Kaufmann draws on his deep knowledge of our daily operations and our industry, customers, suppliers, employees and shareholders to provide the Board with a unique and very important perspective on our business and a conduit for information from management. Prior leadership positions across the company provide him with expertise in the areas of healthcare, distribution operations, finance, international markets, mergers and acquisitions and regulatory compliance. He also provides the Board with an understanding of the strategic and financial implications of business, regulatory and economic factors impacting our company from having played an important role in key strategic initiatives, including the Red Oak Sourcing joint venture with CVS Health. In addition, Mr. Kaufmann brings relevant experience and perspectives to the Board from his service on the board of directors of MSC Industrial Direct, including service on its Audit and Compensation Committees. | |||

Other public company boards | |||

Current MSC Industrial Direct Co., Inc. | Within last five years None | ||

| Cardinal Health | 2020 Proxy Statement 13 |

Age

Director since 2007

Board Nominating and Governance, Ad Hoc, Surgical Gown Recall Oversight

Independent Chairman of the Board |

| GREGORY B. KENNY | |

President and Chief Executive Officer of General Cable Corporation (retired) | |||

Background | |||

Mr. Kenny served as President and Chief Executive Officer of General Cable Corporation, a global manufacturer of aluminum, copper and fiber-optic wire and cable products, from 2001 until 2015. Prior to that, he was President and Chief Operating Officer of General Cable from 1999 to 2001 and Executive Vice President and Chief Operating Officer from 1997 to 1999. Mr. Kenny previously served in executive level positions at Penn Central Corporation, where he was responsible for corporate business strategy, and in diplomatic service as a Foreign Service Officer with the U.S. Department of State. | |||

Qualifications | |||

Mr. Kenny | |||

Other public company boards | |||

Current

Ingredion Incorporated | Within last five years

| ||

Cardinal Health |2019 Proxy Statement11

Age

Director since 2015

Board Human Resources and Compensation, Surgical Gown Recall Oversight

Independent Director |

| NANCY KILLEFER | |

Senior Partner, Public Sector Practice, McKinsey & Company, Inc. (retired) | |||

Background | |||

Ms. Killefer served as Senior Partner of McKinsey & Company, Inc., a global management consulting firm, from 1992 until 2013. She joined McKinsey in 1979 and held a number of key leadership roles, including serving as a member of the firm’s governing board. Ms. Killefer founded McKinsey’s Public Sector Practice in 2007 and served as its managing partner until her retirement. She also served as Assistant Secretary for Management, Chief Financial Officer and Chief Operating Officer for the U.S. Department of Treasury from 1997 to 2000. | |||

Qualifications | |||

Having served in key leadership positions in both the public and private sectors and provided strategic counsel to healthcare and consumer-based companies during her 30 years with McKinsey, Ms. Killefer brings to the Board substantial experience in the areas of strategic planning, including healthcare strategy, and marketing and brand-building. Her extensive experience as managing partner of McKinsey’s Public Sector Practice and as a chief financial officer of a government agency provides valuable insights in the areas of government relations, public policy and finance. Ms. Killefer also brings to the Board valuable perspectives and insights from her service on the board of directors of | |||

Other public company boards | |||

Current

Natura &Co Holding S.A. Taubman Centers, Inc. | Within last five years Avon Products, Inc. CSRA, Inc. Computer Sciences Corporation The Advisory Board Company | ||

www.cardinalhealth.com | Cardinal Health | 2020 Proxy Statement 14 |

Age

Director since

(previously 1996 – 2009)

Board Audit

Independent Director |

| J. MICHAEL LOSH | |

Executive Vice President and Chief Financial Officer of General Motors Corporation (retired) | |||

Background | |||

Mr. Losh served as Executive Vice President and Chief Financial Officer of General Motors Corporation, a global automobile manufacturer, from 1994 to 2000. He spent 36 years in various capacities with General Motors. Mr. Losh also previously served as our interim Chief Financial Officer from July 2004 to May 2005 and was a director of Cardinal Health from 1996 through our spin-off of CareFusion Corporation in 2009. | |||

Qualifications | |||

We elected Mr. Losh to the Board in December 2018 due to his immediate ability to chair our Audit Committee based on his financial expertise and prior service on our Board. | |||

Other public company boards | |||

Current Amesite Inc. Aon plc

Masco Corporation

| Within last five years

| ||

Amesite has registered securities with the U.S. Securities and Exchange Commission under Section 12(g) of the Securities Exchange Act of 1934 and became subject to the reporting obligations of that Act, but we do not view Amesite as a “public company” for governance purposes because Amesite’s securities currently are not listed on any stock exchange or quoted on an over-the-counter market.

Age

Director since

Board Audit

Independent Director |

| DEAN A. SCARBOROUGH | |

Chairman and Chief Executive Officer, Avery Dennison Corporation (retired) | |||

Background | |||

Mr. Scarborough served as Chairman and Chief Executive Officer of Avery Dennison Corporation, a packaging and labeling solutions company, from 2014 to 2016. Prior to that, he served as Avery Dennison’s Chairman, President and Chief Executive Officer from 2010 to 2014 and as its President and Chief Executive Officer from 2005 to 2010. After stepping down as Chief Executive Officer, Mr. Scarborough remained Chairman of the Board through April 2019. Having joined Avery Dennison in 1983, Mr. Scarborough served in a series of leadership roles both in the United States and abroad until he was appointed Chief Operating Officer in 2000 and later Chief Executive Officer. | |||

Qualifications | |||

Having served as Avery Dennison’s Chief Executive Officer for 11 years, Mr. Scarborough brings to the Board substantial experience in manufacturing and distribution operations. As a former public company chief executive officer, he has relevant experience in finance, human resources and corporate governance. He also brings a global business and manufacturing perspective, having led Avery Dennison’s Label and Packaging Materials Europe business while he was based in the Netherlands. Mr. Scarborough also brings to the Board valuable perspectives and insights from his service on the board of directors of Graphic Packaging Holding Company, including service on its Audit Committee, and prior service on Mattel, Inc.’s board of directors. | |||

Other public company boards | |||

Current Graphic Packaging Holding Company | Within last five years Avery Dennison Corporation Mattel, Inc. | ||

| Cardinal Health | 2020 Proxy Statement 15 |

Age

Director since

Board Audit, Surgical Gown Recall Oversight

Independent Director |

| JOHN H. WEILAND | |

President and Chief Operating Officer, C. R. Bard, Inc. (retired) | |||

Background | |||

Mr. Weiland served as President and Chief Operating Officer of medical device company C. R. Bard, Inc. from 2003 until 2017, when Bard was acquired by Becton, Dickinson and Company. He also served on Bard’s board of directors from 2005 to 2017, becoming Vice Chairman of the Board in 2016. Mr. Weiland joined Bard in 1996 and held the position of Group President, with global responsibility for several Bard divisions and its worldwide manufacturing operations prior to becoming President and Chief Operating Officer. Prior to Bard, he held senior management positions at Dentsply International, American Hospital Supply, Baxter Healthcare and Pharmacia AB. | |||

Qualifications | |||

Mr. Weiland brings over 40 years of healthcare industry experience to the Board, including executive leadership at a medical device company and significant international business experience. He has relevant experience in regulatory compliance, global markets and manufacturing operations. Mr. Weiland also brings to the Board valuable perspectives and insights from his service on the board of directors of Celgene Corporation, including service on its Audit Committee, and prior service on West Pharmaceutical Services’ board of directors, including chairing its Compensation and Finance Committees. | |||

Other public company boards | |||

Current

None | Within last five years Celgene Corporation C. R. Bard, Inc. West Pharmaceutical Services, Inc. | ||

Cardinal Health |2019 Proxy Statement13

Our director nominees possess relevant skills and experience that contribute to a well-functioning Board that effectively oversees our strategy and management.

Director Nominee Skills and Experience |

|

|

| Darden | Downey | Edison | Evans | Hemingway Hall | Johri | Kaufmann | Kenny | Killefer | Losh | Scarborough | Weiland | |||||||||||||

Board leadership as a board chair, lead director or committee chair equips directors to lead our Board and its Committees |

|  |

|

|

|  |

|

|

|

|

|  |

|

|

|  |  |  |  |  | ||||||||

Financial expertise as a finance executive or CEO brings valuable experience to the Board and our management team |

|

|

|

|

|  |

|

|  |

|  |

|  |

|  |

|  |

|  |  |  |

| ||||||

Healthcare expertise as a leader of a healthcare company or a consulting firm with a healthcare practice provides industry experience |

|  |

|

|

|  |

|  |  |  |

|

|  |

|

|  |

|  |

|

|  | |||||||

Operations experience increases the Board’s understanding of our distribution and manufacturing operations |

|  |

|  |

|

|

|

|

|

|

|

|

|

|

|  |  |  |  | |||||||||

Regulatory/legal/public policy experience helps the Board assess and respond to an evolving business and healthcare regulatory environment |

|  |

|

|

|  |

|  |

|

|  |

|

|  |  |

|

|

|  | |||||||||

International experience brings critical insights into the opportunities and risks of our international businesses |

|

|

|

|

|  |  |

|

|

|

|

|

|  |  |  |

|

|  |  |  | |||||||

Information technology experience contributes to the Board’s understanding of the information technology aspects of our business |

|

|

|

|

|

|

|  |  |  |

|

|

|

|

|

|

www.cardinalhealth.com | Cardinal Health | |

Our Board’s Composition and Structure

Our Board Leadership Structure

Mr. Kenny has served as the independent, non-executive Chairman of the Board since November 2018, when we separated the Chairman and Chief Executive Officer roles. Prior to that, he served as independent Lead Director (elected annually by the independent directors) since November 2014.

In addition to serving as a liaison between the Board and management, key responsibilities of the Chairman include:

calling meetings of the Board and independent directors;

setting the agenda for Board meetings in consultation with the other directors, the Chief Executive Officer, and the corporate secretary;

reviewing Board meeting schedules to ensure that there is sufficient time for discussion of all agenda items;

reviewing and approving Board meeting materials before circulation;circulation and providing guidance to management on meeting presentations;

chairing Board meetings, including the executive sessions of the independent directors;

participating in the annual Chief Executive Officer performance evaluation;

acting as an advisor to Mr. Kaufmann on strategic aspects ofconferring with the Chief Executive Officer role,on matters of importance that may require Board action or oversight;

as a member of the Nominating and Governance Committee, evaluating potential director candidates, assisting with regular consultations on major developmentsdirector recruitment, recommending committee chairs and decisions;membership, and recommending updates to the company’s Corporate Governance Guidelines; and

holding governance discussions with large investors.

The Board considered a wide range of factors in determining that its current leadership structure is the most appropriate arrangement at the present time, including current market practice and the views of shareholders. The Nominating and Governance Committee periodically reviews, assesses and makes recommendations to the Board regarding the Board’s leadership structure.

Our Corporate Governance Guidelines provide that the Board should be diverse, engaged and independent. In identifying and evaluating candidates for the Board, the Nominating and Governance Committee considers the diversity of the Board, including diversity of skills, experience and backgrounds, as well as ethnic and gender diversity. We believe that our Board nominees reflect an appropriate mix of skills, experience and backgrounds and strike the right balance of longer serving and newer directors.

Does not include Mr. Losh’s prior service on our Board from 1996 to 2009.

Cardinal Health |2019 Proxy Statement15

Cardinal Health | 2020 Proxy Statement 17 |

How We Identify, Add and On-Board New Directors

The Nominating and Governance Committee is responsible for identifying, reviewing and recommending director candidates, and our Board is responsible for selecting candidates for election as directors based on the Nominating and Governance Committee’s recommendations.

While the process may vary depending on the director candidate, our general approach is the following:

Ms. Hemingway Hall and Mr. Kenny identifiedrecommended Mr. Losh as a potential candidate for consideration by the NominatingEvans, and Governance Committee. Mr. Losh had the immediate ability to chair our Audit Committee, based on his financial expertise and prior service on our Board, after two key Audit Committee members, including the former chair, left the Board last Fall. In addition, Mr. Losh brings extensive public company board experience.

A search firm retained by the Nominating and Governance Committee identified Mr. Scarborough, and Mses. Cox and Hemingway Hall, who serve on the Celgene board of directors with him, identified Mr. Weiland,Kenny recommended Ms. Edison, as potential candidates for consideration by the Nominating and Governance Committee. Mr. Scarborough brings to the Board substantialEvans has previous public company chief financial officer experience and served as our interim Chief Financial Officer for nine months through May 2020. Ms. Edison has extensive experience as a formersenior legal executive at public companies in the medical device and packaging industries. Both have previous public company Chief Executive Officer with manufacturingboard experience and distribution operations experience. Mr. Weiland has executive leadership experience at a medical device company, as well as significant international business experience.are independent directors.

New directors typically participate in a comprehensive, full-day director orientation program, which includes meetings with senior management. This orientation program helps new directors become familiar with our business and strategy, significant financial matters, ethics and compliance program, corporate governance practices and risk management and human resources functions.

The Board held sixnine meetings during fiscal 2019.2020. Each director attended 75% or more of the meetings of the Board and Board committees on which he or she served during the fiscal year. Average director attendance at all Board and Board committee meetings was 96%.

All of our directors at the time attended the 20182019 Annual Meeting of Shareholders. Absent unusual circumstances, each director is expected to attend the Annual Meeting of Shareholders.

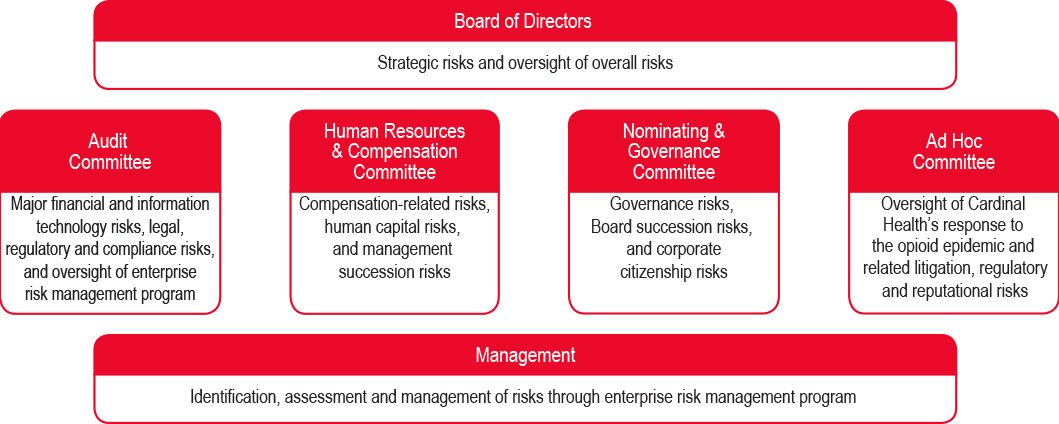

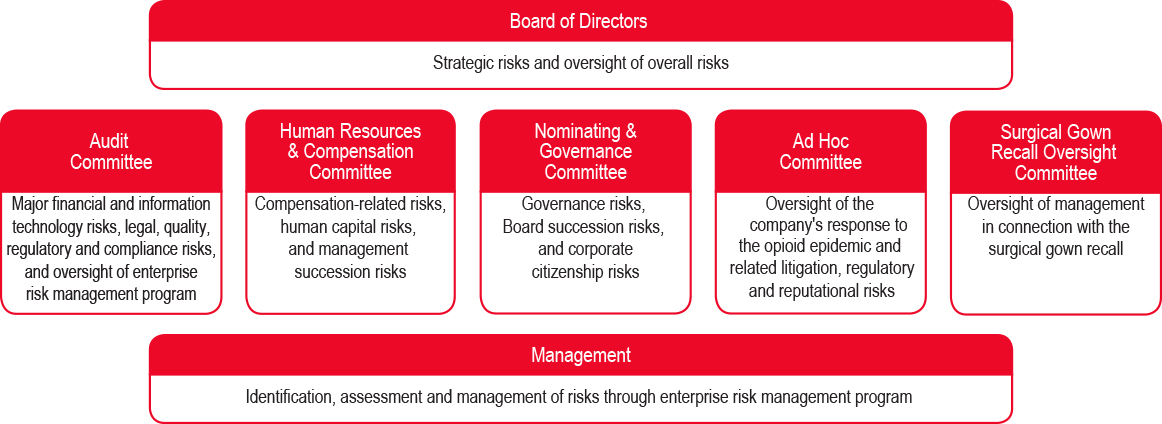

The Board has an Audit Committee, a Nominating and Governance Committee and a Human Resources and Compensation Committee (the “Compensation Committee”). Each member of these committees is independent under our Corporate Governance Guidelines and under applicable committee independence rules.

The charter for each of these committees is available on our website at www.cardinalhealth.com under “About Us — Corporate — Investor Relations — Corporate Governance — Board Committees and Charters.” This information also is available in print (free of charge) to any shareholder who requests it from our Investor Relations department.

The Board also has an Ad Hoc Committee of independent directors formed in 2018 to assist the Board in its oversight of opioid-related issues.

Backissues and a Surgical Gown Recall Oversight Committee of independent directors formed in 2020 to Contentsassist the Board in oversight of a surgical gown recall.

Members:

J. Michael Losh (Chair) Colleen F. Arnold Akhil Johri Dean A. Scarborough John H. Weiland

Meetings in fiscal

| The Audit Committee’s primary duties are to: ● oversee the integrity of our financial statements, including reviewing annual and quarterly financial statements and earnings releases and the effectiveness of our internal and disclosure controls; ● appoint the independent auditor and oversee its qualifications, independence and performance, including pre-approving all services by the independent auditor; ● review our internal audit plan and oversee our internal audit department; ● approve the appointment of our Chief Legal and Compliance Officer and oversee our ethics and compliance program and our compliance with applicable legal and quality and regulatory requirements; and ● oversee our major financial and information technology risk exposures and our process for assessing and managing risk through our enterprise risk management program. The Board has determined that each of Messrs. Johri, Losh and Scarborough is an “audit committee financial expert” for purposes of the U.S. Securities and Exchange Commission (“SEC”) rules. |

Ms. Arnold has decided not to stand for re-election at the Annual Meeting and her term will expire at that time.

Messrs. Scarborough and Weiland became members of the Audit Committee in September 2019.

www.cardinalhealth.com | Cardinal Health | 2020 Proxy Statement 18 |

Nominating and Governance Committee

Members:

Patricia A. Hemingway Hall (Chair) Bruce L. Downey Gregory B. Kenny

Meetingsinfiscal | The Nominating and Governance Committee’s primary duties are to: ● identify, review and recommend candidates for the Board, including recommending criteria to the Board for potential Board candidates and assessing the qualifications, attributes, skills, contributions and independence of individual directors and director candidates; ● oversee the Board’s succession planning; ● make recommendations to the Board concerning the structure, composition and functions of the Board and its Committees, including Board leadership and leadership structure; ● review our Corporate Governance Guidelines and governance practices and recommend changes; ● oversee our environmental sustainability and other corporate citizenship activities, including our policies and practices regarding political and lobbying activities and expenditures; and ● conduct the annual Board evaluation and oversee the process for the evaluation of each director. |

Clayton M. Jones served as chair of the Audit Committee until his term expired at the 2018 Annual Meeting of Shareholders. David J. Anderson served on the Audit Committee until he resigned from the Board in September 2018. Mr. Downey served on the Audit Committee until September 2019.

Mr. Losh became chair of the Audit Committee in December 2018 when he joined the Board.

Ms. Arnold became a member of the Audit Committee in November 2018. She served on the Nominating and Governance Committee until November 2018.

Messrs. Scarborough and Weiland became members of the Audit Committee in September 2019.

Ms. Hemingway Hall became chair of the Nominating and Governance Committee in November 2018.

Mr. Downey became a member of the Nominating and Governance Committee in November 2018.

Cardinal Health |2019 Proxy Statement17

Human Resources and Compensation Committee

Members:

Carrie S. Cox (Chair) Calvin Darden Patricia A. Hemingway Hall Nancy Killefer

Meetingsinfiscal | The Compensation Committee’s primary duties are to: ● approve compensation for the Chief Executive Officer, establish relevant performance goals and evaluate his performance; ● approve compensation for our other executive officers and oversee their evaluations; ● make recommendations to the Board with respect to the adoption of equity and incentive compensation plans and policies, administer such ● review our non-management directors’ compensation program and recommend changes to the Board; ● oversee the management succession process for the Chief Executive Officer and senior executives; ● oversee and advise the Board about human capital management strategies and policies, including with respect to attracting, developing, retaining and motivating management and employees, workplace diversity and inclusion initiatives and ● oversee and assess material risks related to compensation arrangements; and ● assess the independence of Compensation Committee’s consultant and evaluate its performance. The Compensation Discussion and Analysis, which begins on page |

Cardinal Health | 2020 Proxy Statement 19 |

Members:

Bruce L. Downey (Chair) Carrie S. Cox Calvin Darden Gregory B. Kenny

Meetingsinfiscal | The Ad Hoc Committee assists the Board in its oversight of ● progress of the global settlement framework designed to resolve all pending and future opioid lawsuits by states and political subdivisions; ● investigations and ● anti-diversion and controlled substance reporting programs; ● risks posed to ● changes in the regulatory and legislative environment; ●

● engagement with shareholders, employees |

Surgical Gown Recall Oversight Committee

Members: John H. Weiland (Chair) Akhil Johri Gregory B. Kenny Nancy Killefer Meetingsinfiscal2020:7 | The Surgical Gown Recall Oversight Committee assists the Board in overseeing and engaging with management regarding the company’s surgical gown recall announced in January 2020.(1) It receives and discusses reports from management and the company’s external advisors and provides management input and direction. It also provides advice, reports and recommendations to the Board. Since its formation, the Surgical Gown Recall Oversight Committee has discussed, among other things: ● the status of the |

● regulatory aspects of the | |

● the ● our quality assurance processes and business practices; and ● media and reputational impacts. |

As disclosed in our fiscal 2020 Form 10-K, in January 2020, we issued a voluntary recall for 9.1 million AAMI Level 3 surgical gowns and two voluntary field actions (a recall of some packs and a corrective action allowing overlabeling of other packs) for 2.9 million Presource Procedure Packs containing affected gowns. These recalls were necessary because we discovered in December 2019 that one of our FDA registered suppliers in China had shifted production of some gowns to unapproved sites with uncontrolled manufacturing environments. Because of this, we could not assure sterility of the gowns. In connection with these recalls, we recorded total charges of $85 million during fiscal 2020.

www.cardinalhealth.com | Cardinal Health | |

Our Board’s Primary Role and Responsibilities and Processes

Our Board’s Primary Role and Responsibilities

Our Corporate Governance Guidelines provide that our Board serves as the representative of, and acts on behalf of, all the shareholders of Cardinal Health. In that regard, some primary functions of the Board include:

reviewing, evaluating and, where appropriate, approving our major business strategies, capital deployment and long-term plans and reviewing our performance;

planning for and approving management succession; and

overseeing our policies and procedures for assessing and managing compliance and risk.

How ourOur Board Oversees Our Strategy and Capital Deployment

The Board receives updates on company performance and regularly discusses our strategy considering the competitive environment, developments in the rapidly changing healthcare industry, and the global business and economic environment. The Board reviews and approves capital deployment, including dividends, financing and share repurchase plans, and significant acquisitions and divestitures.

At least annually, the Board conducts a dedicated strategy session with in-depth discussions of our industry, specific businesses and new business opportunities. At these sessions, the Board discusses risks related to our strategies, including risks resulting from possible competitor, customeractions by competitors, disrupters, customers and supplier actions.suppliers. The Board also considers various elements of strategy at each regular quarterly meeting. The collective backgrounds, skills and experiences of our directors, including broad industry experience, contribute to robust discussions of strategy and the related risks.

AsThe Board has supported our goal to deploy capital in a recent example ofbalanced and disciplined manner that prioritizes reinvesting in the business, maintaining a strong balance sheet, and returning cash to shareholders through dividends. Reinvestment in the business through capital expenditures remains a critical priority. Another priority is maintaining a strong balance sheet through our Board’s oversightfocus on our credit rating and engagementthe corresponding metrics. We paid down $1.4 billion in these areas,debt during fiscal 2020. Our board also approved a 1% increase in our dividend during fiscal 2020.

During fiscal 2020, the Board was highly engaged with the Chief Executive Officer and other management had been conducting a comprehensive reviewabout the impact of COVID-19 and the company’s response and plans. Management held regular informational calls with Board members throughout the spring and summer covering employees and operations, financial impact, product supply, media engagement, and related legal and regulatory matters. Management also is engaged with the Board on identifying and addressing strategic risks and opportunities arising out of COVID-19. During the pandemic, we adjusted our portfolio, cost structure and capital deployment. Theplanned in-person Board was actively engaged in this process with detailed analyses and extensive discussions. These strategic initiatives include:

Coststructure: fundamental review of how we operate;

Cordis: repositioning the business for growth;

PatientRecovery: successfully integrating and operating the business;

Pharmaceuticaldistributionbusinessmodel: evaluating the upstream and downstream elementsmeetings to hold them virtually to ensure continued effective functioning of the business model;

Portfolioandpartnerships: simplifying our portfolio of businesses and expanding in critical spaces; and

Capitaldeployment: being disciplined and thoughtful in our approach.

Management has provided updates to investors on the costs savings achieved and progress on other strategic initiatives in its quarterly earnings calls with investors.